Please read our blog about a wide variety of insurance topics. Please feel free to ask us any questions.

Understanding Homeowners Insurance Coverage?

Posted: June 29, 2019

Homeowner Policies typically include a full complement of standard features that cover your dwelling, personal property and other structures. Policies include liability protection, loss of use and medical payments to others. Our homeowners insurance agents will work with you to find the right coverage and can adjust premiums by adjusting deductible amounts as well as applying discounts and credits. We can also add endorsements to your...

Used Car Dealer Insurance? Types & Coverage Details.

Posted: June 22, 2019

Auto Dealer Garage Insurance Texas Auto Dealer Insurance provides coverage for the legal liability of automobile dealers, garages, repair shops and service stations. Coverage includes bodily injury and property damage arising out of garage related operations. It can also provide coverage for damage to customers’ autos and property, as well as damage to garage-owned autos. Click here for a Free Quote Please take a moment to...

Best Uses For Special Event Insurance

Posted: June 20, 2019

In today’s litigious society, it may be wise to consider purchasing special event insurance if you are planning a wedding, a large party, or another event. This type of insurance can help protect your investment in the event and provide liability coverage for various types of potential claims. Speak with our friendly, helpful agency about an insurance policy to cover your special event. What Is...

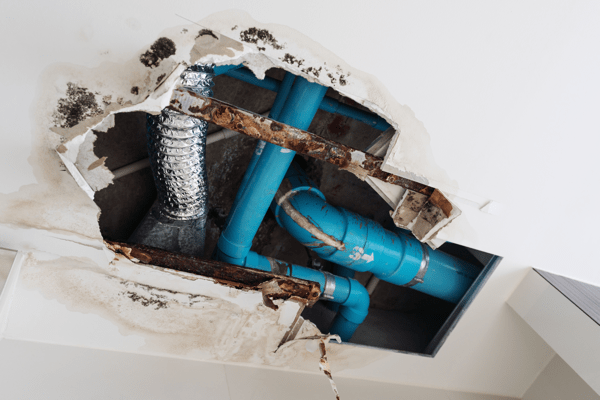

Does My Homeowners Insurance Cover Internal Damage?

Posted: June 18, 2019

When they think of homeowners insurance, many people have fires, storms, and natural disasters in mind. But what about internal damage, such as water leaks and mold? Are these problems covered? Your policy is likely to cover certain types of internal damage, but not all. Our knowledgeable agency will be happy to review your homeowners insurance policy and ensure you are covered for any eventuality....

Surety Bonds Vs. Professional Liability (Errors & Omissions) Insurance

Posted: June 6, 2019

Surety bonds are a useful service, but not the same thing as professional liability insurance, also known as errors and omissions (E&O) insurance. You may need both surety bonds and professional liability insurance to safeguard your business. What Are Surety Bonds? A surety bond is a contract between three or more parties, issued by a surety company on behalf of a party known as the...